Expropriation? Why 100 percent inheritance tax would be better

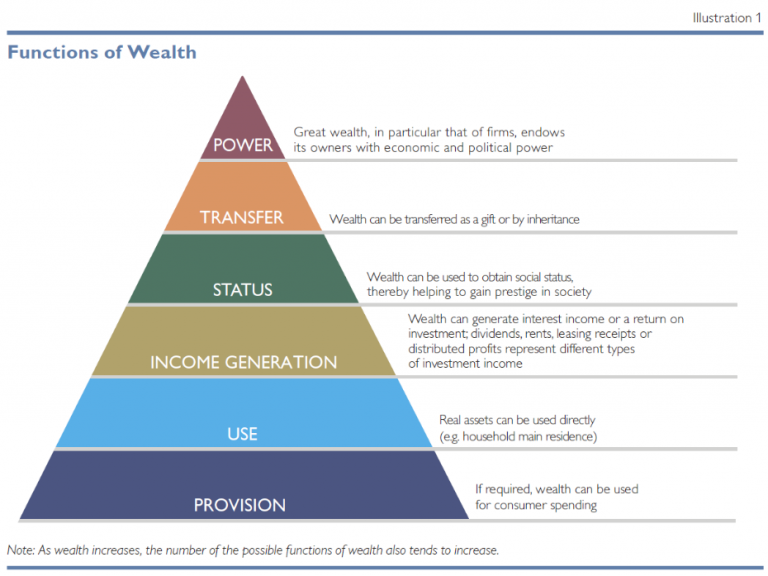

The article explores possible justifications for 100 percent inheritance tax. It’s based on the belief that equality of opportunity is not only a social but also a deeply liberal idea. You can not speak about a meritocracy when you have substantial unearned wealth from the start of some people’s life, and not for others.

Publisher: spiegel.de

Author(s): Sebastian Maas

Date: 3.5.2019

Link to Article (in German)

Those who demand a 100 percent inheritance tax are making a rather superficial error in thinking and are unnecessarily scaring people off. For a (theoretical) perfect equalization of the capital chances it would be enough to skim off the part of the inheritances to 100% which lies over the possible average inheritance which everyone can get.

So why should someone not be allowed to inherit, for example, the 300,000 € house of his parents (which usually means more than just money), if the average inheritance is 300,000 € or more?

Hi Christoph,

thanks for your comment, sorry for the late reply 🙂

I am not sure what you mean by “perfect equalization of the capital chances”, but to answer your question why somebody should not be allowed the 300k€ house of their parents:

Only because 300k€ is the average inheritance (in your example), it’s still a substantial privilege that only a minority enjoys. Averages are difficult numbers. The majority inherits much less. 50% of all inheritance is inherited by the top 10% in Germany (see link below). Many inherit nothing or close to nothing. Inheriting a 300k€ house may not sound like a big deal, but it can have a huge impact on ones life, life planning, risk taking, peace of mind, etc., etc. If you have any friends who have not inherited anything, ask them how they have experienced having their friends inherit something in the dimension of 300k€ and how much of an unfair privilege that was. If you want further arguments, this blog is full of them 🙂

___

https://www.diw.de/de/diw_01.c.809832.de/publikationen/wochenberichte/2021_05_1/haelfte_aller_erbschaften_und_schenkungen_geht_an_die_reichsten_zehn_prozent_aller_beguenstigten.html