A global platform for equal opportunities

Start Equal is founded on a social liberal vision: a world with equal opportunities, not necessarily equal outcomes, but a truly equal and empowered start in life for all. We directly address the “birth lottery”—the profound starting injustice created by inherited privilege that undermines a truly liberal and social market economy.

Framework

Our strategic pillars, starting capital prototypes, and network partners

Analysis

Access our own analysis and policy proposals for discussion.

Background

A collection of media and research articles on inheritance and related topics.

Framework

Our mission is to prototype, promote, and build a global ecosystem for more equal inheritance distribution through a starting capital paid at birth or age of maturity.

We will execute this mission through three core strategies:

- Piloting “Equalstart Capital”: We will run a “Liberty-as-a-Service” platform that provides a trusted service for philanthropists to fund basic capital injections for young people. This is our operational engine.

- Building the Movement: We will unify the global network of starting capital actors and align it with the Unconditional Cash Transfer (UCT) sector active in international development under the principle that “equal opportunity doesn’t stop at borders,” and multiply our model through spinoffs.

- Advocating for Systemic Reform: We will use the data and stories from our pilots as an evidence-based tool to lobby for the ultimate goal: government-led reform of inheritance schemes that channel the bequest streams of one generation into funding a universal inheritance fund for everyone in the next generation.

Analysis & Proposals

Find our own analysis and policy proposals for a more liberal and just inheritance system below.

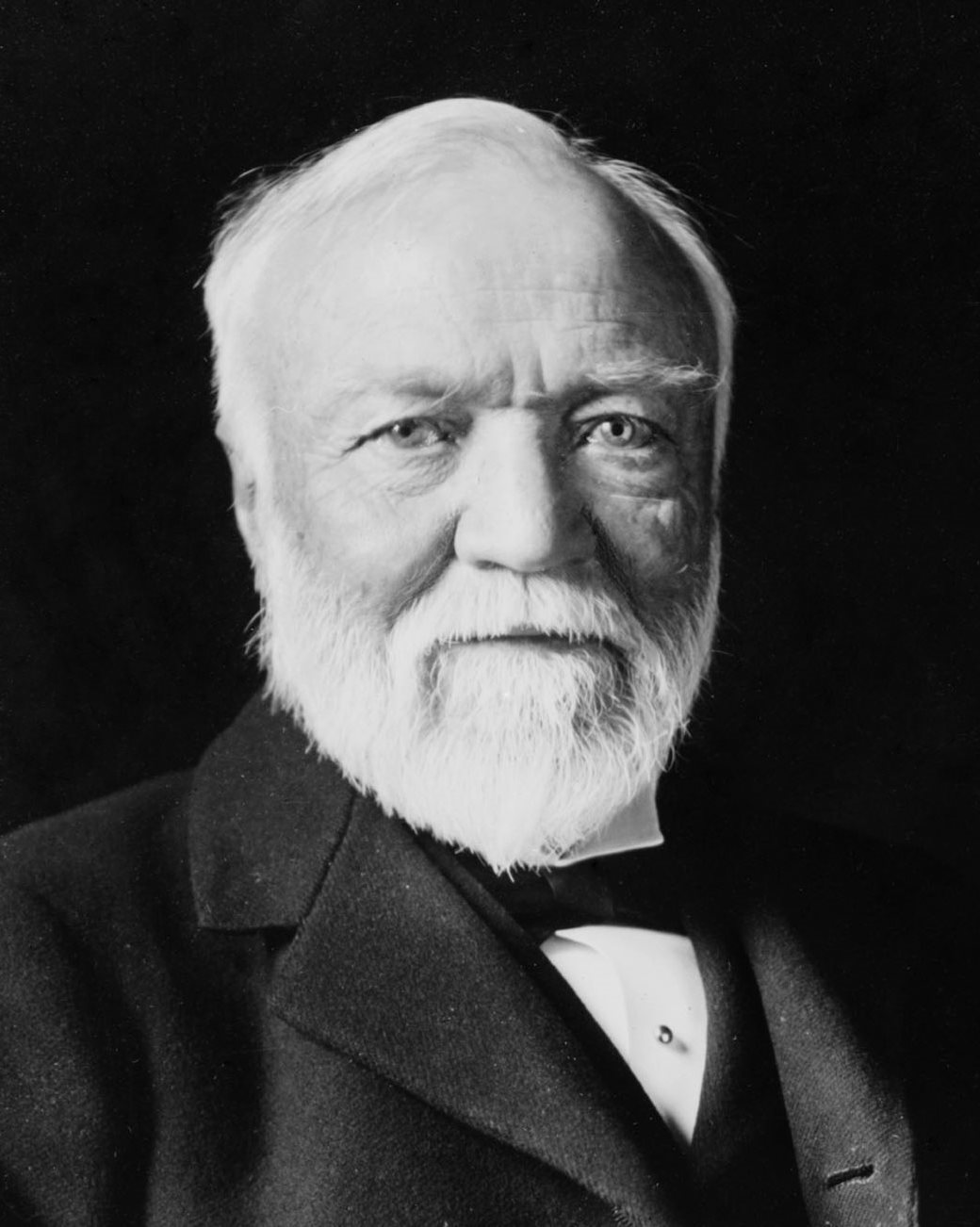

Status and Inheritance: Hanno Sauer’s “Class” analysis.

In the book “Class. The origin of top and bottom.” the author Hanno Sauer makes the claim that that economic redistribution—no matter the form: whether a basic inheritance, UBI, progressive

Simone Weil’s (1943) “right to property” against uprootedness

Simone Weil (1909–1943), was a philosopher who died working for the French resistance movement against Nazi-Germany. She is noted for her intense patriotism, Jewish heritage, and Christian spirituality, possessing a

Ordo-liberalism, starting justice and a universal basic inheritance: Alexander Rüstow

Alexander Rüstow, a towering figure in the German Ordoliberal school of thought, developed his ideas while navigating a tumultuous political period. As an opponent of the Nazi regime, he fled

Matthias Erzberger’s ambitious inheritance reform of 1919

Matthias Erzberger, a pivotal figure in early 20th-century German politics, stands out among proponents of inheritance reform due to his background as an active politician rather than an academic, and

The ‘Abolition of inheritance’: Theodor Oelenheinz

In the times of socialist revolutions in post-war Germany, the lawyer Theodor Oelenheinz, son of a bank director from Karlsruhe, grandson of the former finance minister of Baden (Germany) Karl

Disability and Opportunity: Can Inheritance Bridge the Gap?

One of the underlying assumptions in this text has been that financial privilege correlates with other privileges (see for instance our article on Biological Feudalism). The idea, put simply, is that

Background on Inheritance

Find a curated selection of media and science articles on issues around inheritance, wealth and income inequality, taxation, family business sucession, and more below

Reforming inheritance tax systems: Four guiding principles

Inheritance tax systems can play an important role in increasing social equality, yet across the world, these systems often struggle to achieve their intended aims. Étienne Fize, Nicolas Grimprel and

Earned vs. unearned: the German and Austrian discourse on inheritance tax

The authors of this study have evaluated 3573 arguments within the German and Austrian public discourse on inheritance tax. First clear result: he public opinion goes against inheritance taxes. This doesn’t

Inheritance is key to the concentration of wealth

The paper by Pirmin Fessler and Martin Schürz, both from the Austrian National Bank, argues that, across all euro area countries, inheritance plays a decisive role in defining the relative

Why is it so difficult to tax the rich?

There is a paradox: A great majority of people would benefit from increasing taxes on the rich (and this is particularly true for inheritance taxes), but progressive tax reforms appear

How 100% inheritance tax rates could feed an inheritance fund for everyone

The authors discuss how a 100% inheritance tax regime may be highly contentious but morally justified. The proceeds could go into a general fund from which something like a universal

Optimal inheritance tax rate

Scholars estimate the optimal inheritance tax rate to be around 50%–60% or larger. In a 2012 article, Thomas Piketty and Emmanuel Saez find that the optimal inheritance tax rate might