A global platform for equal opportunities

Start Equal is founded on a social liberal vision: a world with equal opportunities, not necessarily equal outcomes, but a truly equal and empowered start in life for all. We directly address the “birth lottery”—the profound starting injustice created by inherited privilege that undermines a truly liberal and social market economy.

Framework

Our strategic pillars, starting capital prototypes, and network partners

Analysis

Access our own analysis and policy proposals for discussion.

Background

A collection of media and research articles on inheritance and related topics.

Framework

Our mission is to prototype, promote, and build a global ecosystem for more equal inheritance distribution through a starting capital paid at birth or age of maturity.

We will execute this mission through three core strategies:

- Piloting “Equalstart Capital”: We will run a “Liberty-as-a-Service” platform that provides a trusted service for philanthropists to fund basic capital injections for young people. This is our operational engine.

- Building the Movement: We will unify the global network of starting capital actors and align it with the Unconditional Cash Transfer (UCT) sector active in international development under the principle that “equal opportunity doesn’t stop at borders,” and multiply our model through spinoffs.

- Advocating for Systemic Reform: We will use the data and stories from our pilots as an evidence-based tool to lobby for the ultimate goal: government-led reform of inheritance schemes that channel the bequest streams of one generation into funding a universal inheritance fund for everyone in the next generation.

Analysis & Proposals

Find our own analysis and policy proposals for a more liberal and just inheritance system below.

Status and Inheritance: Hanno Sauer’s “Class” analysis.

In the book “Class. The origin of top and bottom.” the author Hanno Sauer makes the claim that that economic redistribution—no matter the form: whether a basic inheritance, UBI, progressive

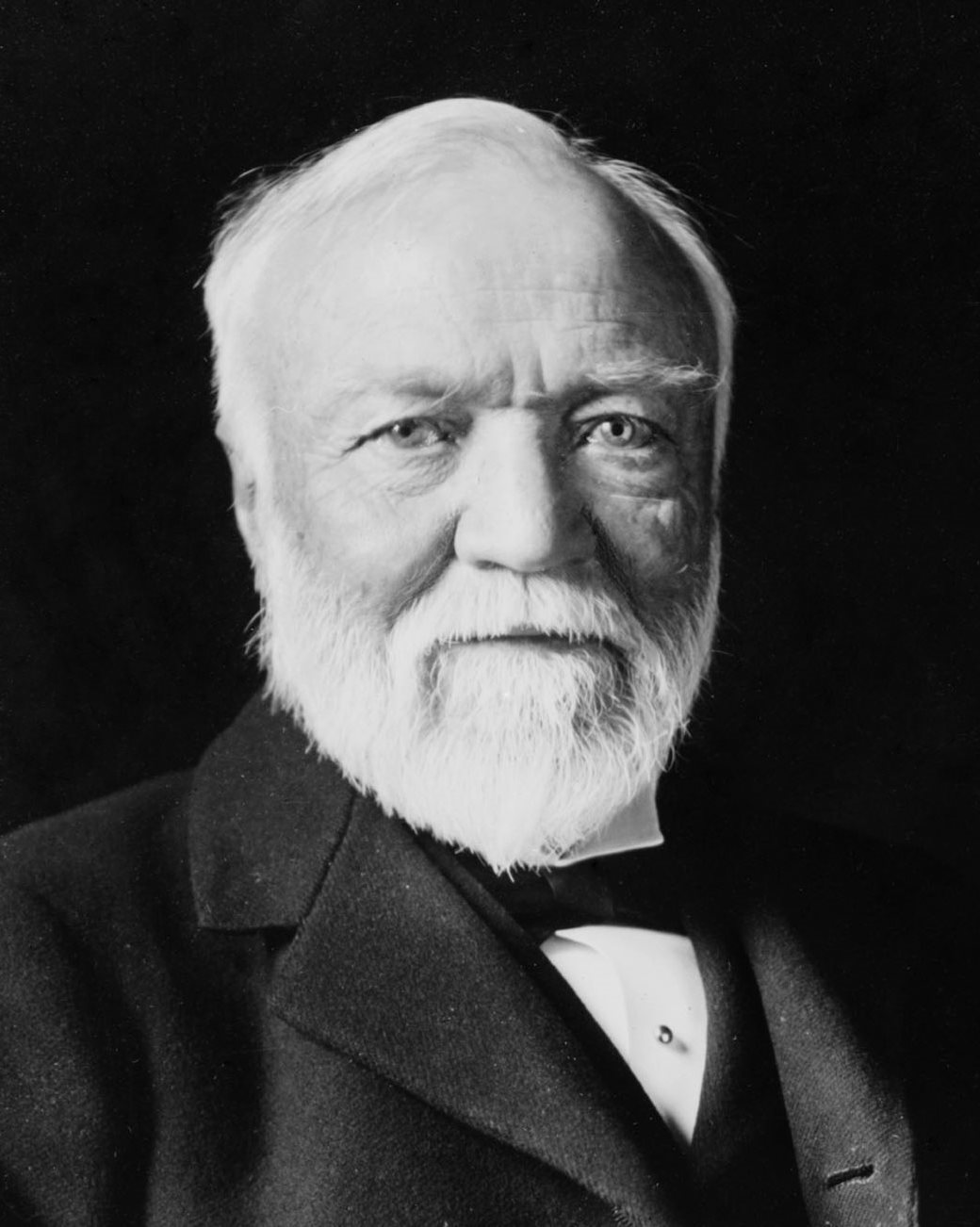

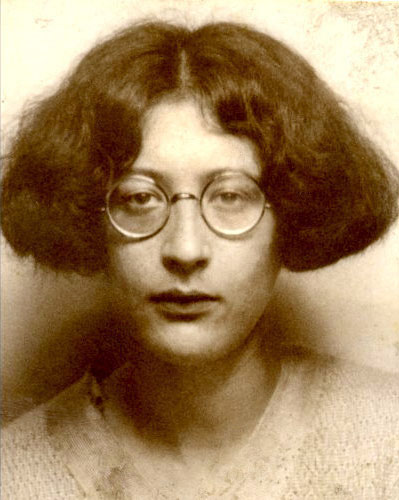

Simone Weil’s (1943) “right to property” against uprootedness

Simone Weil (1909–1943), was a philosopher who died working for the French resistance movement against Nazi-Germany. She is noted for her intense patriotism, Jewish heritage, and Christian spirituality, possessing a

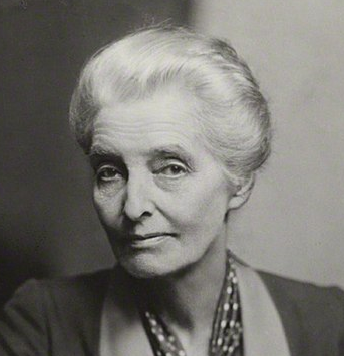

Ordo-liberalism, starting justice and a universal basic inheritance: Alexander Rüstow

Alexander Rüstow, a towering figure in the German Ordoliberal school of thought, developed his ideas while navigating a tumultuous political period. As an opponent of the Nazi regime, he fled

Matthias Erzberger’s ambitious inheritance reform of 1919

Matthias Erzberger, a pivotal figure in early 20th-century German politics, stands out among proponents of inheritance reform due to his background as an active politician rather than an academic, and

The ‘Abolition of inheritance’: Theodor Oelenheinz

In the times of socialist revolutions in post-war Germany, the lawyer Theodor Oelenheinz, son of a bank director from Karlsruhe, grandson of the former finance minister of Baden (Germany) Karl

Disability and Opportunity: Can Inheritance Bridge the Gap?

One of the underlying assumptions in this text has been that financial privilege correlates with other privileges (see for instance our article on Biological Feudalism). The idea, put simply, is that

Background on Inheritance

Find a curated selection of media and science articles on issues around inheritance, wealth and income inequality, taxation, family business sucession, and more below

More than half of all inheritances and gifts go to the richest ten percent

Recent research from DIW Berlin shows how the wave of inheritances increases absolute wealth inequality and that policymakers should counteract this. German private wealth has more than doubled over the

Reforming inheritance tax systems: Four guiding principles

Inheritance tax systems can play an important role in increasing social equality, yet across the world, these systems often struggle to achieve their intended aims. Étienne Fize, Nicolas Grimprel and

A hated tax, but a fair one

NO TAX is popular. But one attracts particular venom. Inheritance tax is routinely seen as the least fair by Britons and Americans. This hostility spans income brackets. Indeed, surveys suggest

The smartest way to make the rich pay is NOT a wealth tax

It’s important to ask the wealthy to pay more, as inequality is rising. However, a wealth tax has several drawbacks and complications. Other taxes like an inheritance tax are preferable.

Why is it so difficult to tax the rich?

There is a paradox: A great majority of people would benefit from increasing taxes on the rich (and this is particularly true for inheritance taxes), but progressive tax reforms appear

Biased media? Study on how inheritance tax debate is represented in the media

Hendrik Theine and Andrea Grisold from Vienna University analysed 10.000 articles in seven quality media over the last 20 years. They discovered deficits in three core areas when it comes