The “Three generation” myth: Does inequality regulate itself over time?

From shirtsleeves to shirtsleeves in three generations.

Wealth never survives three generations.

The father buys, the son builds, the grandchild sells.

The above are all variations of a persistent and widespread belief in what is called the ‘three generation rule’ or ‘third generation curse’. It predicts that family wealth (or more specifically often: family business) that has been built up by the first and second generation vanishes again by the third generation. In light of the inheritance debate the ‘third generation rule’ is sometimes utilised to argue that inheritance taxes are unnecessary as wealth is redistributed naturally over time again. Thus, no need for any intervention. How great would it be if this would be true. Unfortunately, however, the so-called rule is nothing more than a widespread myth, as we shall see below.

The myth debunked

Sometimes the ‘third generation rule’ myth is grounded on some alleged evidence.

“A groundbreaking 20-year study[…] found that seven in 10 families tend to lose their fortune by the second generation, while nine in 10 lose it by the third generation.”[1]

Sounds convincing, no? Maybe it should be added that the study (which seems to be unpublished) has been undertaken by the Williams Group[2], a consultancy earning their money by advisory on family business succession. Is it far-fetched to believe that Williams has a vested interest to strengthen the ‘third generation rule’ belief through creative, non-academic research reports in order to convince family business owners that they need succession advisors?

Academic research actually suggests that the ‘third generation rule’ is more a myth than reality. While in general, it is true that we can observe some ‘regression to the mean’-effects (poor families rising in status and rich families losing wealth) over time, “the process can take 10 to 15 generations (300 to 450 years)”, the historian on social mobility Gregory Clark of University of California has found.[3] For the time horizon of an ordinary human being, this is close to saying, there is hardly any social mobility at all, despite all the various attempts through education, early childhood care, and redistribution. Indeed, the author holds that present-day Sweden is not doing much better in social mobility than feudal and aristocratic England some hundreds of years ago. Does this mean all our attempts to increase equality of opportunity are in vain and don’t make any difference? No, unfortunately not. In line with other research, Clark also admits that living in current-day Sweden is still better than in the United States from a social mobility perspective.

However, what the literature seems to suggest is that Europe may be doing slightly better than the US, but is far away from having shaken off its feudal legacy. Italian researchers have found that socio-economic inheritance is so strong that some of the inequalities we see today date back to the Middle Ages.[4] They show how if you come from a family that was wealthy (top 10%) in 1427 Florence, your expected wealth today will still be 10% larger than the average- nearly 600 years and many upheavals, wars and revolutions later. We don’t see any three-generation rule at work, here. No natural equalisation over time (or at least: too little). What we rather observe is a very persistent inequality of opportunity, handed down dozens of generations.

Dynamic vs. static inequality: A question of mobility

While the ‘third generation rule’ is a myth and certainly doesn’t prove any self-regulation towards equal opportunity over time, it may be interesting to introduce the concepts of dynamic and static inequality in this context as a related discourse. The distinction has recently been emphasised by Nassim Taleb in his Incerto writings, where he defines the two types of inequality as follows[5]:

· Static inequality as a snapshot view of inequality; not reflecting what will happen to you in the course of your life

· Dynamic inequality, taking into account the entire future and past life

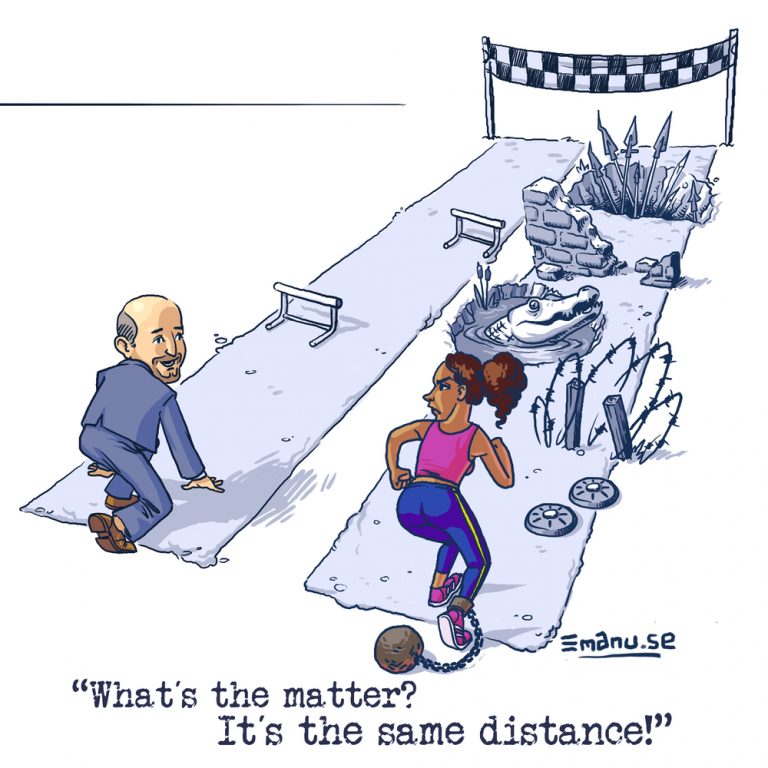

What this distinction is essentially referring to is income and wealth mobility, i.e. the permeability of classes. This social mobility describes the chances for a poor-born person to become rich and for a rich-born person to lose their wealth. If you just look at how wealth or income is spread at a certain moment in time, you don’t capture differences in mobility. Saying that the United States are more unequal than e.g. Europe because the differences in wealth between rich and poor are larger doesn’t tell you anything about the chances of moving up the ranks. Of course, you can assume this is difficult both in Europe and in the United States but is it easier in the US or in Europe? Taleb himself points towards some research that seems to indicate that social mobility may be higher in the US than in Europe, a pattern that would actually fit the narrative of the American Dream vs. the feudal history of Europe. However, other research seems to suggest the opposite. Harvard scientists recently found that the chances of moving up from the bottom 20% to the top 20% of earners is only about 8% in the US, whereas it is around 11% in the UK, France, Italy and Sweden. Similarly, the risk of being stuck all your life in the bottom 20% of the income distribution is higher (~33%) in the US than in Europe (around 28%).[6] Beyond the actual measured reality, the researchers also studied the perceived social mobility and found that Americans are optimistic and overestimate it whereas Europeans are rather pessimistic and underestimate it. Taleb (being an American), in his overestimation of American social mobility, may be an illustrative example of this general finding. The Harvard scientists are not alone in their research findings. Other studies confirm that the US has relatively low intergenerational mobility and that in general higher inequality is associated with lower mobility.[7] The American Dream may thus indeed also be more a myth than reality in the 21st century United States.

Inheritance is unfair either way

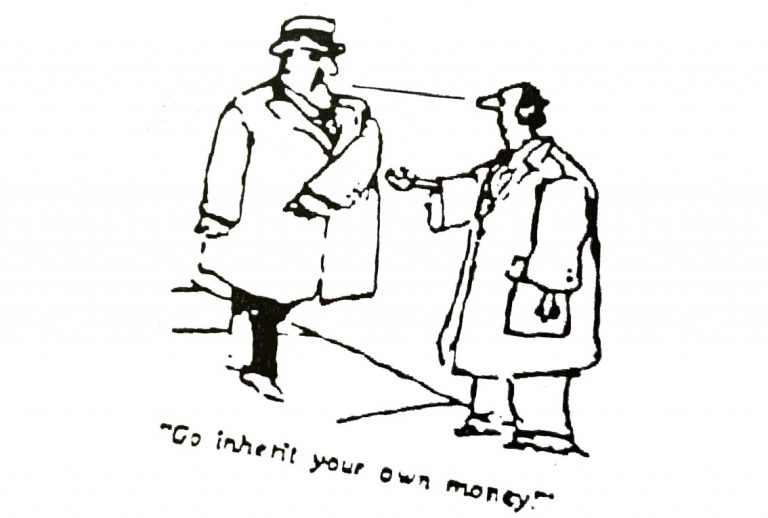

The story that we don’t need to do anything about inheritance because wealth vanished and redistributed automatically again over time is, as we have clearly seen above, a myth. Despite varying degrees of social mobility across countries, privilege is inherited over hundreds of years and multiple generations (not just three). If there is any rule at all, we may call it the ‘like father, like son’ rule.

Besides: Does it actually matter much for individual equality of opportunity whether wealth and privilege are passed on one, two or a hundred generations? Even if there would be a “thee generation rule”, would it matter much for the individuals in the second generation who don’t receive a penny whilst they have to compete in the race of live against the privileged? I don’t think it does. Of course, from a societal, long-term perspective it does matter because the sooner wealth inequalities vanish over time, the less stratified and rigid the society will be, and levels of inequality should be lower. But for the individual who finds himself without any inheritance whether his neighbour inherits a billion, it doesn’t practically matter too much whether that neighbour’s children, grandchildren, or grand-grandchildren will profit from the inheritance. All that matters for the individuals of a current generation are the different opportunities they have at that given point in time.

Let us look at the empirical situation to illustrate this point, citing recent research from Thomas Piketty and fellow researchers:

“Until 1910, the inheritance share was very high in Europe (70–80%). It then fell abruptly following the 1914–45 shocks, down to about 30–40% during the 1950–80 period, and is back to 50–60% (and rising) since around 2010.”[8]

This means that in present-day Europe, less than 50% of wealth is self-earned, and it’s getting harder and harder to build up wealth through self-earned income. Becoming wealthy more and more (again) becomes a matter of birth and lineage less than merit. For somebody belonging to the fortunate heirs, it doesn’t matter so much what will happen in the future and whether the largest part of wealth will be lost again in one, two or (more likely given the historic trends) 10 generations. For the heir, all that matters in his or her life is that she has a fundamental advantage in life, and for the unprivileged, all that matters is that they have a fundamental disadvantage.

To summarise, the ‘three generation curse’ can be debunked as a myth; and for equality of opportunity considerations, any intergenerational inheritance is unfair, no matter whether wealth is passed on for one or multiple generations.

[1] Chris Taylor: “A little honesty might preserve the family fortune” https://www.reuters.com/article/us-money-generations-strategies-idUSKBN0OX1RH20150617

[2] The Williams Group: https://www.thewilliamsgroup.org/our-history

[3] See a New York Times interview with him for a summary, or his full book: Clark (2014): “The Son Also Rises: Surnames and the History of Social Mobility”. The Princeton Economic History of the Western World. https://press.princeton.edu/books/hardcover/9780691162546/the-son-also-rises

[4] Barone and Mocetti (2021): „Intergenerational Mobility in the Very Long Run: Florence 1427–2011,“ The Review of Economic Studies, Volume 88, Issue 4, July 2021, Pages 1863–1891, https://doi.org/10.1093/restud/rdaa075

[5] Nassim Taleb: Inequality and Skin in the Game. https://medium.com/incerto/inequality-and-skin-in-the-game-d8f00bc0cb46

[6] Alesina et al..( 2018). “Intergenerational Mobility and Preferences for Redistribution.” American Economic Review, 108 (2): 521-54. DOI: 10.1257/aer.20162015

[7] See e.g. Corak (2016), Inequality from Generation to Generation: The United States in Comparison. IZA Discussion Paper No. 9929,: http://dx.doi.org/10.2139/ssrn.2786013 or Jantti et al. (2006): “American Exceptionalism in a New Light: A Comparison of Intergenerational Earnings Mobility in the Nordic Countries, the United Kingdom and the United States” IZA Discussion Paper No. 1938, http://dx.doi.org/10.2139/ssrn.878675

[8] Alvaredo et al. (2017), “On the Share of Inheritance in Aggregate Wealth: Europe and the USA, 1900–2010”. Economica, 84: 239-260. https://doi.org/10.1111/ecca.12233