There is no double taxation with inheritance taxes

Opponents of inheritance taxes often claim that the inheritance that is to be taxed had already been taxed before (e.g. through corporate or personal income taxes). As double taxation is often considered something tax regimes wants to avoid (note: in certain contexts, as we shall see), inheritance taxes must be bad and should be avoided.

Let us approach this claim from two sides in this article

- Is inheritance taxation really double taxation?

- If we would accept that inheritance taxation is double taxation, does that also mean it is necessarily problematic and a good counter-argument?

What is double taxation?

When talking about double taxation we should first, however, clarify a bit better, what people really mean by double taxation. To some extent, taxation is always double taxation, because the money that is taxed has somehow been affected by some sort of taxation before in the many economic processes. Income from salaries has been taxed before, e.g. because the customers paid VAT on the products they bought from the company that pays the salary. Few would see problematic double taxation here.

What people usually mean when referring to double taxation is a more narrow form of double taxation where the income of the same person or legal entity is taxed twice. Here, we can distinguish two primary cases:

· taxing the same income twice for different reasons, e.g. first through personal income tax and then through a wealth tax each year thereafter; or on the business level once through corporate taxes on corporate profit and then again through dividend taxes once the profit is distributed to shareholders

· taxing the same income twice for the same reason in two countries, e.g. when you earn income in one country but are a resident of another country. If these countries don’t have double taxation agreements, it may well be that you are liable for income tax in both countries.

Single or Double?

When discussing if inheritance taxation can be regarded as a double taxation, the perspective really matters. Are you looking at the donor/giving side? Then yes, we do have some form of double taxation here. The income that has been earned through salaries, capital gains (see exception further below) or other forms has to some or a full extent already undergone taxation. And not just any taxation paid by anyone in the economic process before it reached the testator, but taxes already paid by the same person. However, if you shift the perspective on the recipient, i.e. the heir, there is no double taxation. Inheritance income for the heir is taxed only once, at the time of or shortly after death.

Now: which perspective is more appropriate? In our chapter on private property we had already argued that the deceased lose all of their rights with the exception of very few and limited post-mortem rights. It would appear more natural not to uphold any rights such as the right of property beyond death, and to instead shift the focus to the recipient of inheritance. This also appears reasonable from an equality of opportunity perspective, which cares more about the starting positions of people in life. At the time of death, opportunity and to a lesser degree also equality are no longer meaningful concepts.

Probably it is for the many good reasons introduced above that worldwide all countries except for three (Denmark, UK, USA) tax the recipient in form of an inheritance tax, not the deceased donor in form of an estate tax.[1] The debate about double taxation, at least legally, is an irrelevant one. An inhertance tax by definition taxes not the estate and the testator, but the heir. Thus, there can’t be double taxation technically.

A slightly more challenging situation arises when we look at gift taxes. Here, we have an exchange of property between two living parties, and so some of the arguments for the focus on the receiving side may be questioned. However, there are two reasons why this can focus can still be upheld. First of all, gift taxes in most countries are designed to prevent tax evasion of inheritance taxes, so they can draw their justifications on the same reasons that we identified for inheritance taxes. Secondly, the basic logic remains: For the receiving side, the income is taxed for the first time, so it may well be taxed at this point without double taxation claims.

Finally, in some cases we actually don’t have any double taxation in the first place, not even if you focus on the giving party. This is the case for unrealised capital gains which have been accrued over time by value increases of capital goods (such as the family house). Many countries let these capital gains untaxed by stepping-up the value that the heir receives to current market value, without that gain being taxed. In such situations, inheritance tax is not double taxation, but it makes sure that the value increase is taxed at least once after all. Without inheritance taxes, there would be no taxation of unrealised capital gains after all, meaning more than 50% of estate value is not taxed at all in some settings.[2]

Would double taxation necessarily be problematic?

We have seen above that the double taxation rhetoric is not very convincing overall, but just for the sake of the argument let’s accept it for a moment. Let’s ignore that the perspective on the recipient is more convincing than the perspective on the giving party, let’s ignore that rights usually vanish upon death, and let’s ignore that large shares of value creation are not taxed twice but in the case of unrealised capital gains they are not taxed even once. Let us pretend there is double taxation. Would it be problematic?

Double taxation even in the narrower form described earlier is not unique to inheritance taxes. When somebody buys something, consumption taxes (or sales taxes) are paid from income that had already been taxed. Few people find this problematic. If it would be problematic, it would mean we could not have both income and consumption taxes at the same time. In fact, the case against consumption taxes is much stronger than against inheritance taxes, if you look at them from a meritcratic perspective. Consumption taxes overproportionally weigh on lower income households and take up a a larger fraction of their income than for richer people who pay the same tax rate but consume less of their income.[3] Thus, a smaller fraction of their income is going into consumption taxes. The tax is thus regressive and anti-meritocratic to some extent. Critics of the presumable double taxation through inheritance taxes somehow are rarely heard to criticise the sales tax- maybe because of its regressive nature that comes in handy for conservative people?

Another example are corporate taxes levied when a company declares a profit and dividend taxes levied when these profits are distributed to shareholders. Both these situations are double taxations, and both are very common and accepted. In the latter case, many tax regimes do try to acknowledge and reduce the degree of double taxation, but a large part often remains.

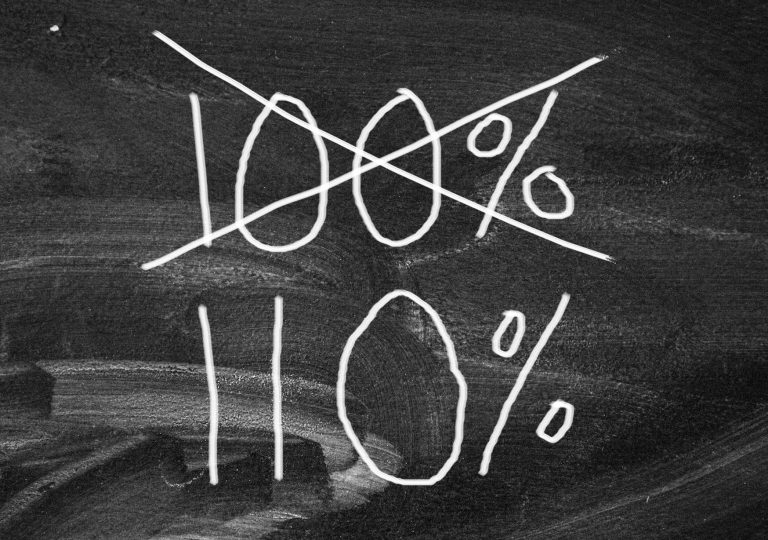

There is no double taxation

To sum it up: There is no double taxation with inheritances taxes, at least not more than in any other tax which obviously deals with money that sooner or later has been subject to some sort of taxation. Nearly all countries tax the receiving party, for which the income definitely is taxed the first time. And there is good reason for this, given that a perspective that focusses on the heir is much more convincing. Dead people lose their rights; and it is in the perspective on the heir that unequal opportunity arises. If we tax earned income such as salaries, we need to tax unearned income at the beginning of the life as well. These arguments should also apply for the few countries which formally tax estates and thus the giving side. These countries should consider abandoning the estate and only focussing on inheritance taxes.

[2] OECD (2021), Inheritance Taxation in OECD Countries, OECD Tax Policy Studies, OECD Publishing, Paris, https://doi.org/10.1787/e2879a7d-en.

Photo Credits: nairobilawmonthly.com