Natural Differences and the Handicap Principle: A case for 200% inheritance tax

“I returned, and saw under the sun, that the race is not to the swift, nor the battle to the strong, neither yet bread to the wise, nor yet riches to men of understanding… but time and chance happeneth to them all.”

ECCLESIASTES

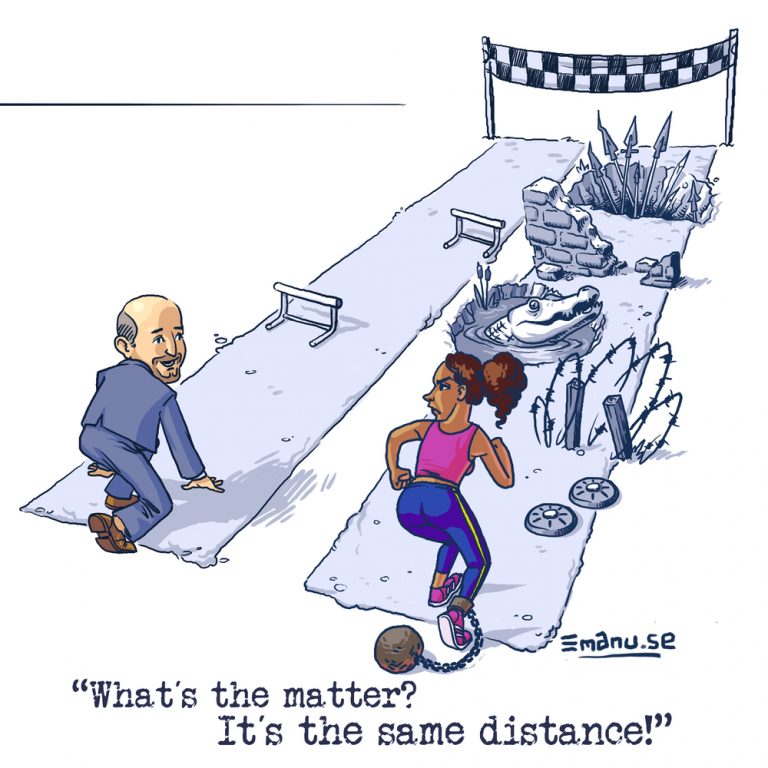

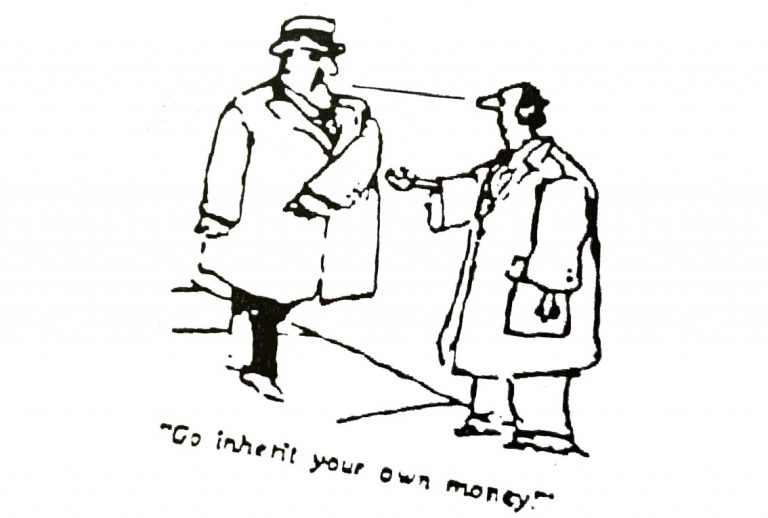

There is a common argument against inheritance tax using a form of ad-absurdum reasoning. It takes the idea of correcting for financial privilege through inheritance tax to its logical extreme by suggesting that if such correction were pursued consistently, it would lead to the (presumably absurd) conclusion of attempting to correct for innate traits like talents, beauty, and character, which is presented as either impractical, impossible or unnatural. It is used to argue for a presumed inconsistency in the logic behind inheritance taxes. In other words, If you want to correct financial privileges, it would only make sense to correct other natural differences as well not to be arbitrary. But as this is presented as a ridiculous thought, it follows that the whole concept of correcting privileges must be flawed.

Are differences natural?

Naturalistic arguments, while appealing on the surface, often fail to hold up under scrutiny. Just because something is “natural” does not necessarily mean it is fair or just. Throughout history, humanity has moved away from solely relying on natural instincts in various domains, embracing principles of justice, equality, and fairness. Therefore, dismissing the idea of correcting natural differences solely on the basis of their innate existence overlooks the progress we have made as a society in transcending mere natural inclinations.

Morover, it is often implied that inheritance is part and parcel of a bundle of differences that are ‘natural’, ‘have always been there’, so we better not touch them. But highly unequal starting positions in life are far from natural. In the (non-human) animal kingdom, inheritance as humans know it does not exist. Instead, nature operates on principles of competition and natural selection, where individuals compete based on their innate abilities and environmental factors. Inheritance, with its perpetuation of wealth across generations, distorts these natural processes and perpetuates inequality.

From an evolutionary economics perspective, inheritance can even be seen as counterproductive to the “natural” elements of our economy, such as competition and natural selection. In a truly competitive environment, individuals would rise or fall based on their own merits, rather than relying on the advantages conferred by inherited wealth. By allowing wealth to be concentrated in the hands of a few, inheritance undermines the principles of meritocracy and hampers economic dynamism. This is to say: Inheritance is not unly unnatural itself, it even prevents the ‘natural dynamics’ of competition and selection to play out in our economy.

Of course, even if the idea of correcting natural differences would be entirely wrong and impractical (and we have shown above it is not), it still doesn’t follow that correcting for the very unnatural differences of inherited wealth should be questioned. On the contrary, we saw that naturalistic arguments can be employed rather in favour of inheritance taxes than against it.

Is correcting natural differences impossible?

Correcting natural differences can be criticised in a few ways. First, there are some measurement challenges: Unlike financial privilege, which can be quantified and taxed, talents, character traits, and other inborn advantages are often subjective and difficult to measure accurately. Attempting to assess and correct for such traits would require intrusive and potentially unreliable evaluation methods, leading to practical challenges and concerns about fairness. Even if you could measure one such trait (intelligence with IQ tests), how could you compare this to other advantages, e.g., physical strength, health, emotional intelligence, humour etc? Human beings are incredibly diverse in their talents, character, and innate abilities. Developing a comprehensive system capable of accurately assessing and correcting for this wide range of individual differences would be practically impossible. Any attempt to do so would likely result in oversimplification and injustice. Additionally, measurements usually suffer from subjectivity and instability. What one person may perceive as an advantage, another may see as a disadvantage, and what may be considered a privilege in one context or stage of life may become irrelevant or even detrimental in another.

Another argument states that policies aiming to correct for inborn advantages could have unintended consequences, such as discouraging individual initiative and innovation. Suppose individuals know that their success will be artificially limited or penalized due to factors beyond their control. In that case, they may be less motivated to develop and utilize their talents to their full potential. This presumes that the measurement of differences would be done via observing results rather than directly measuring capabilities.

The strongest argument against correcting natural differences is related to personal liberty, dignity, and agency. Correcting for inborn advantages could require significant government intervention in the personal lives of individuals, infringing upon their autonomy and freedom. Policies aimed at redistributing talents or character traits would be deeply intrusive and could lead to resentment and backlash from those subject to such measures. As the philosopher Michael Sandel has rightfully argued in his refutational book against meritocracy, the luck-egalitarian attempts to correct for people’s inborn abilities may put those officially diagnosed as “less-fortunate” into a very uncomfortable position of being victimised and stigmatised (undermining their dignity) and presented as helpless and lacking agency. If you are found to be the unlucky one, you may accept your fate and become a passive receiver of support. Or one step further, for those struggling despite government intervention towards improving their opportunities, it must seem that there is no one to blame but themselves. Even if it is true, Sandel argues that this is the harsh downside of any society that claims to be meritocratic.

Refuting the dignity/autonomy/liberty line of argumentation against correcting natural differences is difficult. Here’s an attempt: Imagine a (futuristic) situation where at birth, we all have the same opportunities because:

- Inheritance is redistributed equally among us, so we all have a smooth start in life, can finance our education, and have some little investment capital into our lives

- Based on a mix of indicators measured and documented at birth (to minimise actively influencing these indicators), we are assigned a unique tax multiplier applied on the general income tax framework. Those indicators use genetic data to forecast future intelligence, mental and physical capability, and health developments. The tax multiplier will work so that if two people work the same job and earn the same income, the person with fewer opportunities pays less taxes. The multiplier can also become negative and result in a negative tax burden. Suppose somebody has had a very difficult starting position in terms of ability and health and can only work part-time in a low-paid job. In that case, the tax becomes negative and adds additional income for this individual. Another individual in the same part-time, low-pay job may not get any government support but pay taxes on the job because of more opportunities in life.

Is it implausible that our genes and epigenetics influence our chances in life? Wouldn’t it be good to correct these unequal starting positions? Isn’t it likely that technology will allow to measure those biological differences somewhat accurately soon? Would equalising opportunities through the suggested hypothetical tax multiplier really be such a significant infringement on liberty, autonomy and dignity? More than we currently do by classifying people into normal vs. disabled or stigmatising by sending kids to low, medium and high-level schools (like in Germany)? Would the stigma of “I only have a below-average tax multiplier” really outweigh the advantages of equalising opportunities? And should we leave all the natural advantages untouched because measuring them is simply too difficult?

These are difficult questions. It seems difficult to take a clear stance here. Certainly, there is substantial ‘equality of opportunity potential’ in the area of inborn differences. However, there are also severe obstacles involved in realising this potential.

The Handicap Idea: 200% inheritance tax

Correcting for natural differences does not necessarily require intrusive or impractical measures, as discussed in the previous section, where you have all sorts of problems ranging from measuring intelligence and other abilities, stigmatising people, and setting wrong incentives (“appear stupid to get favourable treatment…”).

A much easier and less problematic option to correct for non-monetary privileges can be achieved via inheritance taxes higher than 100%. For instance, implementing a 200% inheritance tax system could provide a non-intrusive way to compensate for inherited advantages. Under such a system, children from wealthy backgrounds would not inherit anything but would instead be assigned a financial handicap, akin to a tax debt, to be paid back to the state gradually over time. This is based on the finding that sociocultural privilege correlates with financial privilege: If my parents are wealthy, chances are good I also went to a good school, adapted a useful habitus, grew into a solid social network, etc. Therefore, if these two types of privileges correlate, we can simply “double-correct” the monetary privilege (which we can measure easily) to prevent having to measure the socio-cultural privilege. This handicap approach acknowledges the moral imperative to level the playing field without necessitating invasive measurements of individual characteristics.

To some (limited) extent, this handicap seems to be reflected in the intuitive/implicit moral of some privileged people (often family business heirs) who publicly speak about the responsibilities that come with privilege, where privileges are perceived as a duty to work extra hard, to earn back the privilege, to give back to society, to make the most out of the privileges, etc.

Of course, there are some problems with the handicap approach as well, at least in this simplistic form of 200% inheritance tax. What if I came from a wealthy background and grew up highly privileged, but my parents donated their wealth to a charity before they died, resulting in no handicap despite high sociocultural privilege? Or the other way around, I grew up in difficult and poor social conditions with my mother, I never saw my father, and only learned at his death that he got to substantial wealth at the end of his life. Hence I would get a handicap, depite coming from below average background. In both cases, the handicap principle in the form of a 200% inheritance tax would not produce socially desirable results from an equality of opportunity viewpoint. In the first case, an alternative measure of financial privilege may be applied to circumvent the problem, e.g. by measuring the average financial wealth or income of your parents, either until your birth or until you have grown into legal adulthood. This might better depict your privilege than the snapshot of inheritance. Of course, further problems and measurement issues arise with such indicators.

There may be incentive problems in any 200% inheritance tax setup, in the sense that such a handicap tax may influence the working and saving behaviour of parents. If I am financially damaging my child’s future, I may not work as hard or save as much as without such a measure. This is argument is already brought forward for “normal” inheritance taxes below or up to 100%, and has been discussed elsewhere. In short: studies show that motivation to work and save comes from different sources than just the bequest motive. Additionally, both from a degrowth as well as AI/automation perspective, reduced work motivation can actually be a good thing for planet and people. Such taxes may help people to realise they can’t “take anything with them”, nor unduly favour their children, so they may just reassess their priorities in life and find meaning beyond “work, earn, inherit”.

From the viewpoint of the focus of this article, it may be doubted how large the connection between monetary inheritance and natural differences is. While intelligence, character and health are partially hereditary in a genetic, epigenetic or socio-cultural sense, other natural traits (such as specific talents) are not. Or they may be related to genes, but not directly correlated between generations. Lastly, natural differences occur not only because of and across financial hierarchies. People of very similar financial backgrounds may be gifted with different degrees of talent(s). A 200% inheritance tax as a handicap approach would be wholly ignorant and ineffective about those differences. However, it may be argued that if we had eradicated all other (more structural) inequalities, such pure “bio lottery” inequalities could be much more acceptable. It may indeed make a difference in our moral reasoning whether someone is privileged actively through structural imbalances in the parent generation or whether somebody is privileged merely by some lucky gene combination.

The proposal of a 200% inheritance tax is not meant to be a realistic ‘ready to implement’ policy proposal but rather a conceptual framework to think about how to address privileges that go beyond money. Maybe a 200% inheritance tax is not the right solution, but simply ignoring non-monetary privileges such as access to a favourable network, inheritance of a door-opening habitus and psychological stability (among many others) can also not be the solution. The point of this article is to say: If you think 100% inheritance tax is too radical, I have to tell you: It wouldn’t even be enough to create equal opportunities in life.

Further Reading

[1] Sandel (2021). The Tyranny of merit : can we find the common good? Picador.

[2] Arnesan (2004). Luck Egalitarianism Interpreted and Defended. Philosophical Topics, Vol. 32, No. 1/2, Agency (SPRING & FALL 2004), pp. 1-20

Image Credit: “Kari Miller- paralympic Amputee” by TORCH MAGAZINE is licensed under CC BY-NC-ND 2.0.