Property rights and the freedom to bequest

The question of whether a deceased person does still enjoy legal rights, and if so: which, is certainly a very interesting one in the inheritance tax debate. This paper is largely arguing from the perspective that a deceased person loses most if not all its legal rights and that it is thus the receiving party, the inheritor, which needs to be the subject of interest.

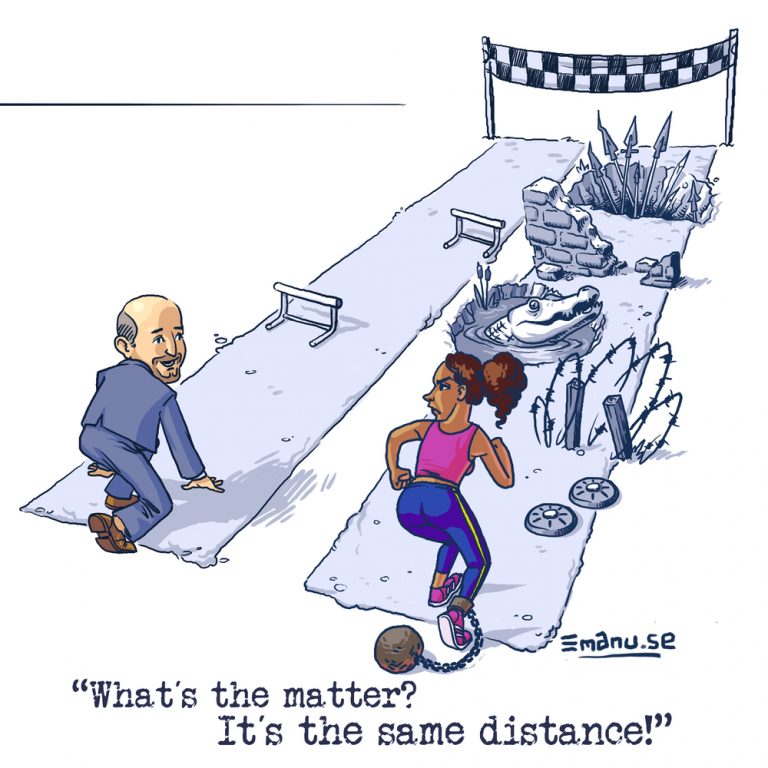

When focusing on the inheritor, it is very hard to argue for any right to inheritance, especially when striving for equality of opportunity and meritocracy. How can we ever call a society meritocratic (that is, a society in which benefits are distributed according to merit, performance or achievements), in which the largest share of wealth is distributed entirely unearned by means of inheritance?

It should become clear that the perspective on the receiving party is quite central to this line of argumentation and this whole paper. Therefore, we need to address the difficult question of why this position seems appropriate to take, that is: Why can we focus more on the inheritor and (at least somewhat) disregard the position of the testator?

No rights after death?

Legal rights are usually proclaimed for the living. They are designed to “control, protect, and punish”[1] the living members of society. In most jurisdictions, the dead lose all or most of their rights upon death. A quote from an American law case illustrates this:

“After death, one is no longer a person within our constitutional and statutory framework,

and has no rights of which he may be deprived”[2]

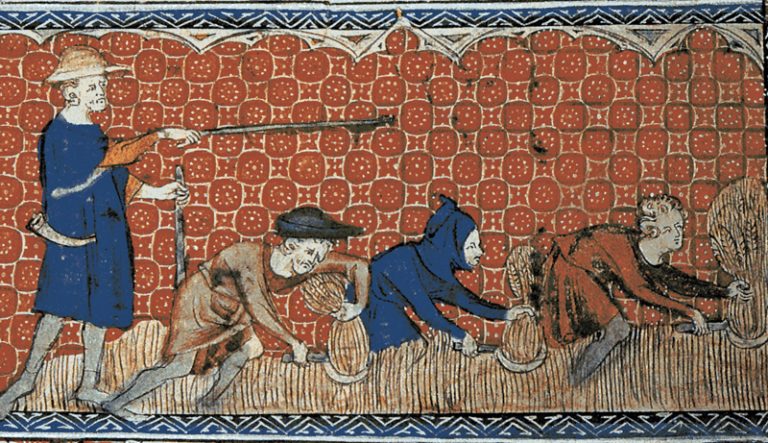

Yet, when it comes to burial requests, testaments, organ donations, and even publicity rights, it seems that many societies grand their deceased some certain set of rights beyond death. The right to bequest is among the most central rights in this group. It is a right that can be found in most constitutions of the world and goes back far in history:

“In one form or another, the right to pass on property—to one’s family in particular—has been part of the Anglo-American legal system since feudal times.” [3]

For some, the right to bequest is among the most central property rights. In this view, bequeathing is an extended form of owning. It is a right that takes effect after death but means to fulfill a right that you had when you were still alive.

Limits to postmortem rights

What is the reason why we grant some few rights to the deceased, while denying them the largest share of rights at the same time? Law literature primarily sees the reasons in our respect for the dignity and the will of the deceased. [4] But if the justification for postmortem rights lies in respect for the desedent’s dignity and will, we should also be able to find its limits there. In the German constitution, the right to inherit is granted explicitly, yet immediately followed by a reference to its limits and that private property in general needs to serve the common good. Where inheritance does not contribute to dignity or where the realization of the will of the deceased person counteracts the dignity of other people, postmortem rights must find their limits.

Wealth – of which in many western societies 50% or more is inherited – can be associated with undermining dignity of the less wealthy. [5] They can contribute to relative poverty, and hinder equal access to opportunity. Generally, where there is such conflict of interest, we usually hold that the right of the living shall supercede the right of the deceased. Similarly, where one right conflicts with another, we acknowledge different ranks and importances of different rights. Dignity enjoys highest legal protection, e.g. as first article of the German constitution. Where inheritance conflicts with dignity, it may rightfully be limited.

Lastly, postmortem rights often have a time-relation. The further time progresses, the less postmortem rights are respected and enforced. This can be seen for rights around a dignified treatment of grave and name of the deceased as well as in publicity and copyright. Time frames in which these rights are foregone can be as short as 30 years. If we take into account that bequeathing can negatively influence equality of opportunity and the dignity of the less fortunate for a life-time or multiple life-times, we can see why limiting inheritance may be called for also from a time perspective. The shelf-life of the postmortem inheritance right is shorter than the duration of the negative effect of the fulfilment of that right.

What to conclude

Let’s summarise our findings:

- Generally, legal rights are lost upon death.

- There is a few exceptions to this general notion, and the right to bequest is a central one

among the postmortem rights. It has a longstanding tradition in many jurisdictions. In fact, it is even seen as a central element of property rights in general. - The justification for postmortem rights appears to be driven largely by a respect for the dignity and will of the decedent as well as societal functions of such rights.

- Where inheritance contributes to severe inequality in society, it inflicts on the dignity of those left out of these inheritance flows.

- The rights of the living are weighed higher than the rights of the deceased.

Can a 100% inheritance tax without exemption limits be justified against this backdrop? It seems, this would be difficult. All this boils down to a great (legal) balancing act, where respect for dignity and will of the deceased needs to be brought in line with catering for the dignity and equality of opportunity of new generations. As the negative effects of bequests may rise exponentially with size of the estate volume, the above line of arguments calls for limiting larger inheritance flows, rather than abolishing bequests altogether. The smaller the inheritance, the less problematic from an equality of opportunity perspective, the less threatening for a dignified live for all society members.

The whole debate about postmortem rights in the context of inheritance also brings up an interesting question: If there is some good arguments for passing on wealth from deceased to descendent, wouldn’t the argument be even much stronger for wealth transfer between living people? Should gift taxes be much lower on non-existent when compared to inheritance taxes? We will turn to these interesting and challenging questions in a future article. Stay tuned.

Further Reading

[1] Kirsten Rabe Smolensky, “RIGHTS OF THE DEAD”, HOFSTRA LAW REVIEW, 2009 https://law.hofstra.edu/pdf/Academics/Journals/LawReview/lrv_issues_v37n03_CC4.Smolensky.final.pdf

[2] State of Conner by Conner v. Ambrose, (N.D.Ind. 1997), 990 F. Supp. 606 (N.D. Ind. 1997), https://casetext.com/case/state-of-conner-by-conner-v-ambrose

[3] United States Supreme Court, HODEL v. IRVING(1987), No. 85-637, https://caselaw.findlaw.com/us-supreme-court/481/704.html

[4] Smith 2020: The Constitution After Death, Columbia Law Review

[5] Chistian Neuhäuser, Reichtum als moralisches Problem, Suhrkamp, 2018