Earned vs. unearned: the German and Austrian discourse on inheritance tax

The authors of this study have evaluated 3573 arguments within the German and Austrian public discourse on inheritance tax. First clear result: he public opinion goes against inheritance taxes. This doesn’t come as a surprise. More insightful are the main and common arguments that are employed against inheritance taxes:

1) ineffectiveness due to tax evasion strategies;

2) problems around how to value assets; and

3) the state as the receiver of inheritance tax to be an inefficient, wasteful institution.

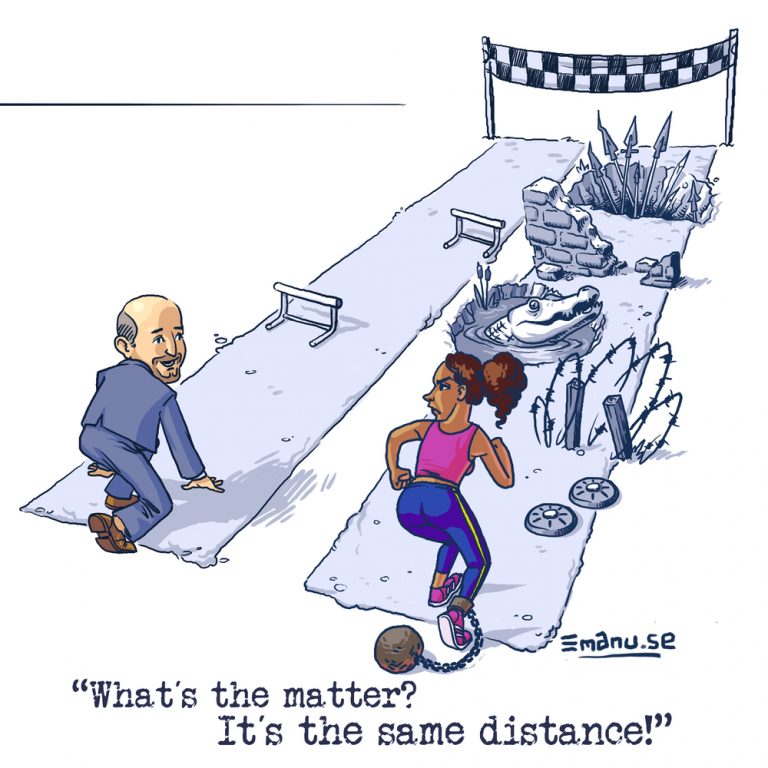

In terms of which ideological grounds serve as a basis of reference for both sides, it’s interesting to see that liberalism and meritocracy play a key role in both sides. The key difference lies in the perspective: the anti-tax view looks at the giving party – the testator – and sees problems around double taxation and disappropriation of earned wealth, while the pro-tax view looks at the receiving party – the heir – and can only see unearned income. Surprisingly, company sucession which usually features prominently in the academic and political discourse did not play any role in the public discourse studied. The authors conclusion of the discourse it that it will need the pro-tax side to convince the anti-tax side that the money raised through inheritance taxes is spent wisely and effectively, e.g. on education.

Publisher: Berliner Journal für Soziologie

Author(s): Jens Beckert | H. Lukas R. Arndt

Date: 19.12.2017

Link to Article

_________________________